Cloud payroll platform is revolutionizing the way businesses manage their payroll processes, introducing efficiency and flexibility that traditional systems simply can’t match. As companies increasingly shift to digital solutions, understanding the benefits and features of cloud payroll becomes essential for staying competitive.

This innovative approach not only simplifies payroll management but also enhances integration with accounting and HR systems, making it a crucial tool for modern organizations. From improved compliance to streamlined operations, cloud payroll platforms offer a comprehensive solution that can adapt to the unique needs of various industries.

Introduction to Cloud Payroll Platforms

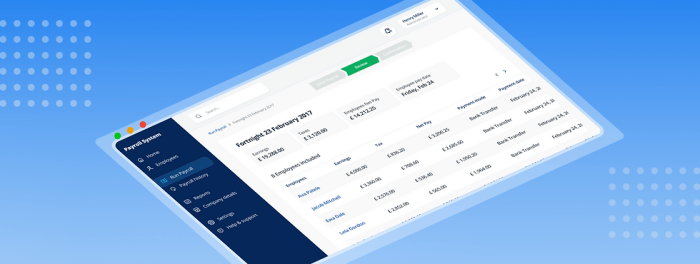

Cloud payroll platforms represent a modern solution for managing payroll processes through internet-based systems. In today’s fast-paced business environment, these platforms are significant as they offer flexibility, accessibility, and real-time updates, which traditional payroll methods struggle to provide. By leveraging cloud technology, businesses can streamline their payroll operations, ensuring accuracy and compliance while saving valuable time.The advantages of using cloud solutions for payroll management are numerous.

First, they allow for automatic updates to tax laws and regulations, which reduces the risk of compliance issues. Additionally, cloud payroll systems often come with user-friendly interfaces that make it easy for employees to access their pay information and for HR departments to manage payroll efficiently. Key features that distinguish cloud payroll platforms from traditional systems include automated reporting, mobile access, and integration capabilities with other business applications.

Business Accounting and Cloud Payroll Integration

Integrating cloud payroll platforms with business accounting processes can significantly streamline operations. This integration allows for seamless data transfer between payroll and accounting software, reducing manual entry and the potential for errors. For instance, popular payroll solutions like Gusto and QuickBooks Payroll offer robust integrations that help businesses maintain accurate financial records.The impact of automated payroll calculations on financial accuracy cannot be overstated.

By automating these processes, businesses ensure that payroll calculations are precise, timely, and in compliance with current regulations, thereby enhancing overall financial integrity.

Human Resources and Employee Management

HR departments greatly benefit from implementing cloud payroll platforms, as these systems simplify the management of employee records and compliance issues. With features that centralize data storage, HR teams can easily track employee information, benefits, and tax withholdings. When comparing traditional payroll methods to cloud-based HR management tools, it’s clear that the latter provides greater efficiency and reliability. Cloud-based systems allow for real-time updates and access, which is vital for managing a diverse workforce effectively.

Payroll in Business Advertising

For advertising agencies, cloud payroll platforms have significant implications. These solutions address unique payroll challenges, such as fluctuating project budgets and diverse payment schedules for freelancers and contractors. Some specific payroll challenges that cloud solutions can effectively resolve include:

- Managing multiple payment structures for different types of employees.

- Ensuring compliance with various labor laws across different locations.

- Integrating payroll data with project management tools to inform budgeting and resource allocation for advertising campaigns.

Industry-Specific Applications: Agriculture

Cloud payroll platforms provide unique benefits to agricultural businesses, particularly in managing complex payroll scenarios associated with seasonal labor. For instance, farmers can easily adjust payroll based on the labor demands of different seasons, ensuring that workers are compensated accurately.Examples of payroll complexities in the agriculture sector include:

- Managing varying pay rates for seasonal workers versus permanent staff.

- Tracking hours worked during busy planting and harvesting seasons.

Cloud solutions offer streamlined processes for these challenges, enhancing overall efficiency in labor management.

Architecture and Interior Design Payroll Solutions

Architecture and interior design firms have unique payroll needs that can be effectively addressed by cloud payroll systems. These firms often operate on project-based billing, requiring precise tracking of employee hours and project costs.Cloud payroll can enhance project-based billing through features that allow for:

- Tracking time spent on different projects.

- Automated invoicing based on billable hours.

The impact of payroll on cash flow in design firms is also significant, as timely payments can influence project timelines and client satisfaction.

Business Branding and Payroll System Alignment

Payroll transparency plays a crucial role in enhancing a company’s brand reputation. By aligning payroll practices with overall business branding strategies, organizations can build trust and improve employee satisfaction. Businesses can align their payroll practices by:

- Ensuring fair pay practices that reflect company values.

- Communicating payroll policies clearly to employees.

Case studies of brands that improved their image through effective payroll management demonstrate the tangible benefits of this alignment.

Business Travel and Payroll Tracking

Cloud payroll platforms assist businesses in managing travel-related expenses efficiently. By integrating payroll with travel and expense management systems, companies can streamline reimbursement processes for employees.Methods for integrating payroll with travel systems include:

- Using mobile applications for expense tracking.

- Linking travel bookings with payroll systems for automatic reimbursement calculations.

The implications of payroll on employee reimbursements during travel highlight the need for accurate tracking and timely payments.

Change Management in Payroll Systems

Implementing a cloud payroll platform requires effective change management strategies to ensure a smooth transition. Organizations may face challenges such as resistance from employees accustomed to traditional systems.A step-by-step guide for effective change management in payroll systems includes:

- Conducting training sessions for staff.

- Communicating the benefits of the new system clearly.

Anticipating challenges can lead to a more successful implementation process.

Construction Industry Payroll Management

The construction industry faces specific payroll challenges, such as compliance with labor laws and managing a varied workforce. Cloud payroll platforms can improve compliance by ensuring that all payroll practices meet current regulations.Features particularly beneficial for construction payroll management include:

- Tools for tracking hours worked on different job sites.

- Customizable reporting options for subcontractors and employees.

These features enhance overall payroll accuracy and compliance in the construction sector.

Entrepreneurialism and Payroll Flexibility

Startups and entrepreneurs require flexible payroll options that can adapt to their evolving business needs. Cloud payroll platforms offer scalable solutions that grow with the business.Examples of entrepreneurial businesses successfully utilizing cloud payroll include modern tech startups and agile marketing firms that benefit from real-time payroll processing and reporting capabilities.

Business Ethics in Payroll Practices

Ethical considerations in payroll management are critical for maintaining employee trust and satisfaction. Cloud payroll can enhance transparency and accountability by automating processes and providing clear records.Examples of ethical dilemmas related to payroll include misclassification of employees and failure to comply with wage laws. Cloud solutions can help resolve these issues by ensuring accurate tracking and reporting.

Franchising and Payroll Consistency

Cloud payroll platforms provide consistent payroll solutions across franchises, ensuring that all locations comply with local labor laws. Methods to ensure compliance include:

- Standardizing payroll practices across all franchise locations.

- Using centralized systems to monitor compliance.

Tools that support multi-location payroll management in franchising can help maintain consistency and accuracy.

Customer Service and Payroll Support

In the context of payroll platforms, customer service is paramount. Effective support services play a vital role in resolving payroll-related issues and ensuring smooth operations.Examples of effective customer service practices in payroll solutions include:

- Responsive support teams available through multiple channels.

- Comprehensive FAQs and documentation to assist users.

By prioritizing customer service, payroll platforms can enhance user satisfaction and operational efficiency.

Industrial Mechanical Sector’s Payroll Needs

The industrial mechanical sector has unique payroll requirements, including managing specialized labor and compliance with industry regulations. Cloud payroll solutions offer benefits such as:

- Automated tracking of hours for specialized workers.

- Custom reporting features for labor costs and compliance audits.

These features cater specifically to the needs of industrial workers, enhancing overall efficiency in payroll management.

Epilogue

In conclusion, embracing a cloud payroll platform is not just a trend, but a strategic move for businesses aiming to optimize their payroll and human resource operations. With its ability to enhance accuracy, ensure compliance, and provide valuable insights, the future of payroll management is undoubtedly in the cloud.

Essential Questionnaire

What is a cloud payroll platform?

A cloud payroll platform is a digital solution that allows businesses to manage payroll processes online, offering features like automated calculations and integration with accounting systems.

How does cloud payroll improve compliance?

Cloud payroll platforms automatically update to adhere to changing labor laws, ensuring that payroll practices remain compliant without manual intervention.

Can small businesses benefit from cloud payroll solutions?

Yes, small businesses can streamline their payroll processes, reduce errors, and save time using cloud payroll solutions that are often more affordable than traditional systems.

What industries can benefit from using cloud payroll?

Industries such as agriculture, construction, and advertising can significantly benefit from cloud payroll, as these sectors often face unique payroll challenges that cloud solutions can effectively address.

Is training required to use a cloud payroll platform?

While some training may be beneficial, most cloud payroll platforms are designed to be user-friendly, allowing users to efficiently navigate the system with minimal guidance.